I know I am so blessed right now financially when...

Well, there are a lot of factors.

And I don't think there is any reason why I should be mentioning my income streams because it's out of the topic.

But if there is just one thing that has allowed God's financial blessings to come to me so easily and frequently - particularly this past year when I have started earning to make a living and eventually a fortune - it would be the habit of setting a portion of my earnings/profits/salary/income (whatever you would call it), before I actually start spending them. And it is not just for buying a luxurious phone or a dream vacation. I have actually saved up for the good reasons, and it would be an opportunity to share to you how I have done it for over a year now, and how you, too, can follow the same system no regardless of the income you are earning on a monthly basis.

And I don't think there is any reason why I should be mentioning my income streams because it's out of the topic.

But if there is just one thing that has allowed God's financial blessings to come to me so easily and frequently - particularly this past year when I have started earning to make a living and eventually a fortune - it would be the habit of setting a portion of my earnings/profits/salary/income (whatever you would call it), before I actually start spending them. And it is not just for buying a luxurious phone or a dream vacation. I have actually saved up for the good reasons, and it would be an opportunity to share to you how I have done it for over a year now, and how you, too, can follow the same system no regardless of the income you are earning on a monthly basis.

So, what does "pay yourself first" mean?

According to Investopedia, it is a phrase commonly used in personal finance and retirement planning literature that means to automatically route your specified savings contribution from each paycheck at the time it is received.

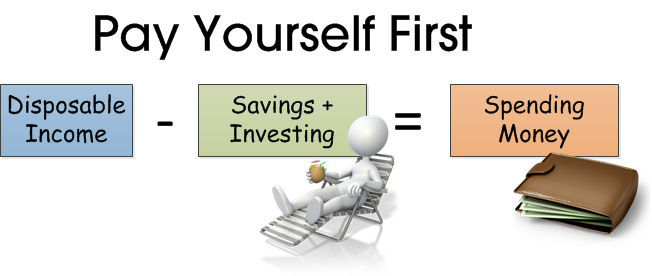

In simple terms, the picture above says it all. The moment you receive your income, what you do first is SAVE, setting aside an amount or percentage of money from it, before you actually go out and SPEND the rest. When you start receiving income at regular intervals, you keep paying yourself first up to the point that it has become a habit for you every time financial blessings come to you.

So basically, that is how I have been managing my money for the past year. With the concept of paying myself first, I am certain that I money comes easily and frequently to me, and with the universe observing this kind of money management, everything around us conspires to receive more wealth because we can be trusted with the wealth that is provided for all of us. Your subconscious would keep reminding you to do it, just like you remind yourself every morning to take a bath in the morning before leaving for work.

Some people are still in the old habit of...

INCOME minus EXPENSES equals SAVINGS

...that is why they end up telling people or themselves "they can't save"

The problem here is that you rely on whatever is left after spending. And with an unconscious habit of spending up to the last centavo, coupled with the loading of more credit card debts due to a shopping spree, saving never becomes a priority.

There are also those who pay their debts, utility bills, loans, and mortgages first before themselves. In the first place, who has worked so hard for the income you received? YOU. Then it is just about time that you give a part of your income to you first before everything else. Remember: INCOME minus SAVINGS equals EXPENSES.

I have actually never heard of paying debt as a savings option.

Apparently, there are also those who technically pay themselves first, but it is all just for material reasons. Saving to buy a particular thing that they crave for months, or even years, is not a problem. But after they get the item or whatever it is, they end up paying themselves last. Rewarding one's self is OK, but paying one's self is even more than OK.

Remember, to pay yourself first is about setting aside your income for not just one reason, but for a number of reasons that can give you long term implications. And I will discuss to them one by one in the succeeding blogs.

While you're just sitting there reading this article, think about the money that has come in and out in your life. It's about time to realize the power of paying yourself first and how we can manage your money properly and faithfully.

No comments:

Post a Comment